Investment Analysis Fundamentals

Understanding how to read financial statements and evaluate market conditions isn't something you pick up overnight. Our twelve-month program breaks down complex investment concepts into practical skills you can actually use when making decisions about capital allocation.

Get Program Details

Core Learning Modules

Each module builds on previous concepts, but we don't rush through material. You'll spend enough time with each topic to actually understand what you're doing – not just memorizing formulas.

Financial Statement Analysis

You'll learn to read balance sheets and income statements without getting lost in the numbers. We focus on spotting trends that matter for investment decisions rather than accounting theory.

Market Valuation Methods

Different assets require different approaches. This module covers practical valuation techniques for equities, bonds, and alternative investments used in European markets.

Risk Assessment Frameworks

Understanding potential downside is just as important as identifying opportunities. We cover systematic approaches to evaluating investment risk in various market conditions.

Portfolio Construction

Building a balanced portfolio involves more than diversification. You'll explore how different assets interact and how to structure allocations based on specific objectives.

Economic Indicators

Macro trends affect investment performance whether you're tracking them or not. This module helps you interpret economic data that influences market movements.

Belgian Market Context

Tax implications and regulatory considerations specific to Belgium matter when making investment decisions. We address local factors that impact portfolio management here.

Who Teaches This Program

Our instructors work in investment analysis and portfolio management. They bring current market experience to the classroom, which means you're learning methods people actually use rather than outdated textbook approaches.

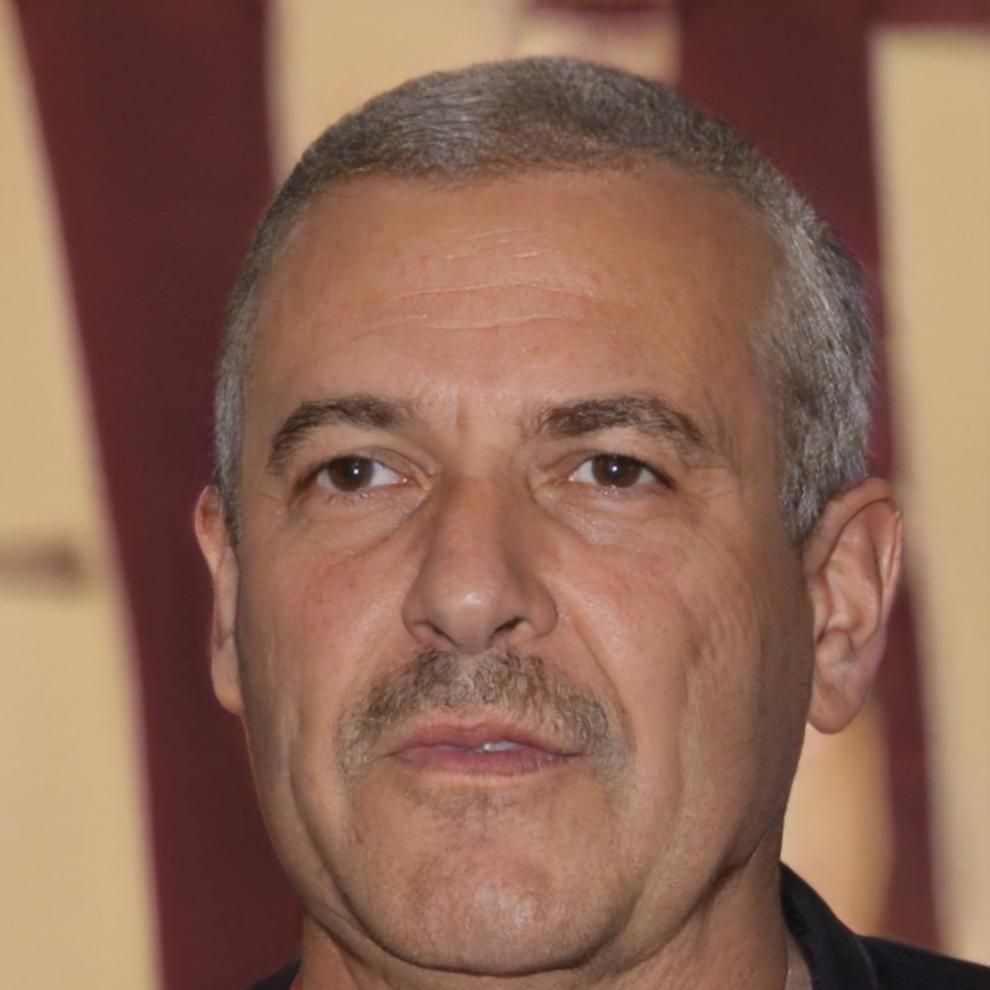

Casper Vanluchene

Equity Analysis

Casper spent fourteen years analyzing European equities for institutional investors before joining our program. He focuses on teaching valuation methods that hold up during market volatility.

Elke Vermeersch

Fixed Income & Risk

Elke manages bond portfolios for a Brussels-based asset manager. She teaches practical risk assessment and how to evaluate fixed income securities in the current interest rate environment.

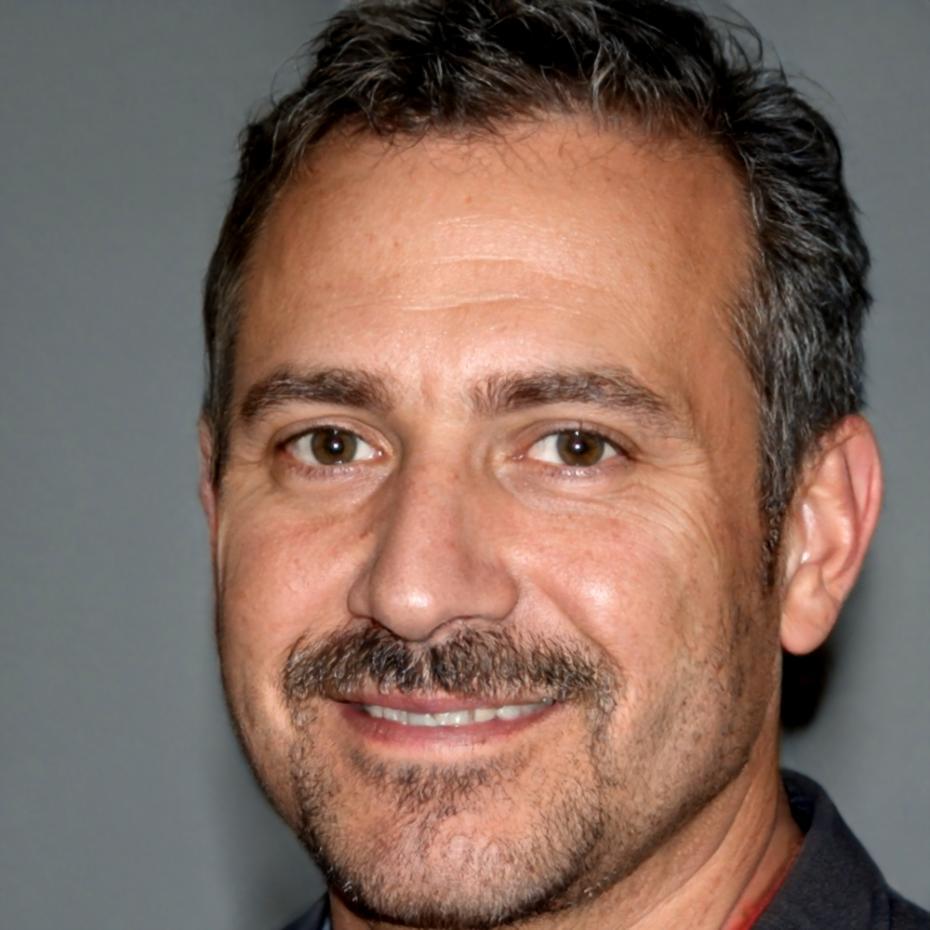

Jasper Debruyne

Portfolio Management

With experience constructing portfolios for private wealth clients, Jasper brings real allocation challenges to class discussions. He covers how theory translates to actual portfolio decisions.

Lennert Claessens

Economic Analysis

Lennert tracks macroeconomic indicators for an investment research firm. He helps students understand how economic data influences investment decisions across asset classes.

Program Timeline

The full program runs twelve months with evening sessions twice weekly. We've designed the schedule for working professionals who want to build investment analysis skills without leaving their current positions.

Next cohort begins September 2025

Foundation Phase

You'll start with financial statement analysis and basic valuation concepts. This phase ensures everyone has a solid understanding of fundamental principles before moving to more complex topics.

Application Phase

This is where you apply valuation methods to real companies and securities. You'll work through case studies based on actual market situations and learn to handle the messy reality of incomplete information.

Portfolio Integration

The final phase focuses on portfolio construction and risk management. You'll build sample portfolios and present your investment thesis and allocation decisions to instructors and peers.

Capstone Project

Your final project involves comprehensive analysis of a portfolio allocation problem. You'll present written analysis and recommendations that demonstrate your ability to apply what you've learned throughout the program.

Ready to Start Learning?

Our program coordinator can answer questions about curriculum details, schedule flexibility, and enrollment requirements. Reach out to discuss whether this program fits your goals.

Contact Program Team